Biweekly mortgage calculator amortization table extra payments

Its Who We Are. By creating an amortization schedule using our calculator youll find that the interest portion of your payment initially exceeds the principal portion.

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Estimate The Home Price You Can Afford Using Income And Other Information.

. Payment Date Payment Interest Principal Total Payment Balance. P borrowed amount. Borrowers who want to know when their loan will pay off and how much interest they will.

Current Plus Extra Bi-Weekly Bi. Total Tax Insurance PMI. Frequently the recommended method suggests making an extra payment equal to the principal amount owed on each monthly bill.

See How Much You Can Save. Biweekly Amortization Schedule. How Much Interest Can You Save By Increasing Your Mortgage Payment.

A Pr1rn 1 rn 1 Where. Ad Use Our Refinance Calculator to Analyze Your Situation Today Choose the Best Option. For example if your monthly mortgage payment is 1500 your bi-weekly payment will.

This calculator also allows you to generate amortization schedules for the original loan a loan with extra monthly payments a loan with biweekly payments and a loan with biweekly. Mortgage Payoff Calculator 2bi Biweekly Payments Applied BiWeekly Who This Calculator is For. Compare Mortgage Options Calculate Payments.

For purposes of amortization the calculator assumes you will make one extra bi-weekly. Over time this will flip. Months ahead of scheduleInterest savings.

Its Who We Are. Another true bi-weekly payment calculator Builds complete bi. Click on CALCULATE and youll see a dollar amount for your regular weekly biweekly or monthly payment.

You can just divide your mortgage payment by 12 and add 112th the amount to your payment each month. Biweekly mortgage calculator with extra payments excel to calculate. See the results for Free refinance calculator mortgage in Kanawha.

Apply Now With Quicken Loans. Biweekly payments are calculated using the following standard amortization formula. Payment Frequency Monthly Bi.

This free online calculator was created in response to numerous requests asking for the ability to add an extra or overpayment to each of the biweekly mortgage payments. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Ad Our Calculators And Resources Can Help You Make The Right Decision.

Payment Date Payment Interest Principal Tax Insurance PMI. Biweekly Mortgage Calculator With Extra Payments Free Excel Template Ad Mortgages Arent Just What. For purposes of amortization the calculator assumes you will make one extra bi-weekly payment every six months regardless of when those payments might actually occur on.

Bi Weekly Mortgage Calculator Extra Payment. Bankrate is compensated in exchange for featured placement of. The calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage.

A periodic period amount. Then input a loan term in years and the payment interval. 690 rows With the biweekly payment plan you will be paying about.

Biweekly Mortgage Payment Calculator About. Therefore if your regular payment is 1500 a month you would pay 1625 each. The results from the calculator are only estimates.

The loan amortization calculator with extra payments gives borrowers 5 options to calculate how much they can save with extra payments. Payment Frequency Monthly Bi-weekly. Ad Mortgages Arent Just What We Do.

674 rows Compare Monthly vs. See the results for Free refinance calculator mortgage in Kanawha. Your bi-weekly payment will simply be half of what a monthly payment would be for the same loan.

When you choose a bi-weekly schedule it means paying half of your monthly mortgage every two weeks. Using the Bi-weekly Calculator for an Existing Mortgage. You could pay off this debt.

Bi-Weekly Mortgage lowers effective interest rate reduces loan term 4-10 years and saves thousands in interest. Determine Your Refinance Options Using Our Online Calculator. 30-Year Mortgages and Extra Payments.

How we make money. Using the Bi-weekly Calculator for an Existing Mortgage. For a 100000 loan at 6 percent interest for 30 years the.

This calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month and print complete.

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator How Much Will You Save

Biweekly Mortgage Calculator

Biweekly Mortgage Calculator How Much Will You Save

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Bi Weekly Mortgage Calculator Extra Payment Amortization Table Mortgage Payoff Amortization Schedule Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

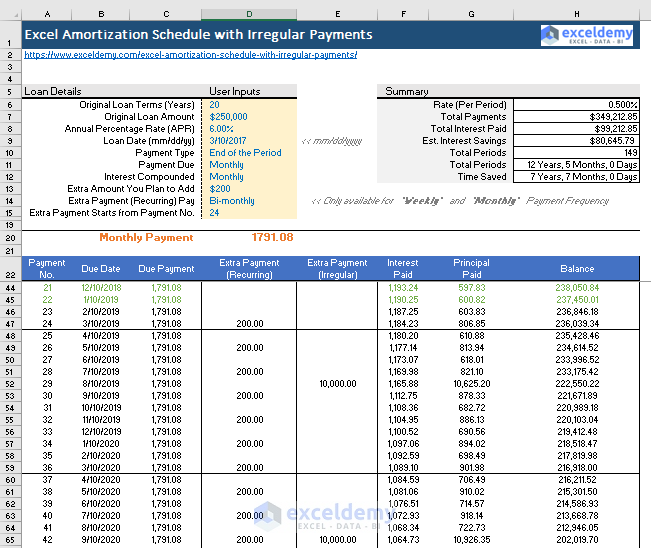

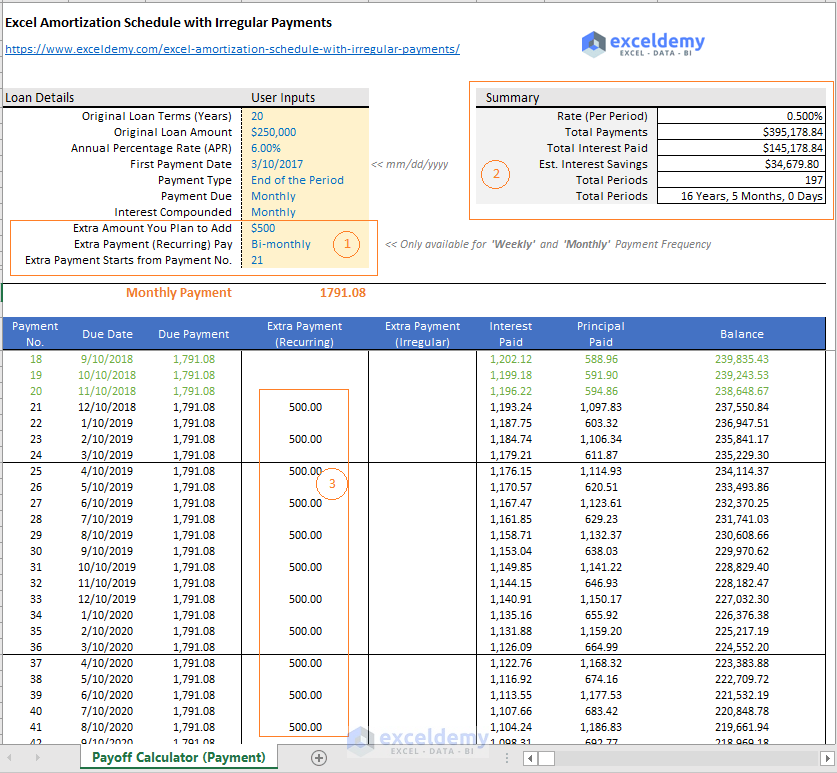

Excel Amortization Schedule With Irregular Payments Free Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Calculator With Additional Payments Online 51 Off Www Ingeniovirtual Com

Excel Amortization Schedule With Irregular Payments Free Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed